Why Choose Forework?

Unlike other payroll and HR software programs, Forework was designed and established by labor and employment law experts, thereby ensuring that businesses receive accurate support for their personnel needs. Forework clients receive sophisticated and seamlessly implemented payroll, tax, and HR technology as well as expert legal support for day-to-day labor issues. With our technology and HR counsel, clients are protected from liability.

Committed to Keeping You Compliant

We guarantee compliance, or you don’t pay for any resulting liability. No other company provides that guarantee.

Our system was built with automated checks and balances that eliminate the guesswork so you can focus your energy on all the other areas that contribute to your organization’s success.

All of our clients receive 10 hours of support from a labor and employment attorney every month (worth almost $55,000 a year) as part of their subscription.

Instead of asking you how to pay your employees (like other payroll providers), we tell you the necessary legal standards, allowing you to make informed decisions for your business.

Flexibility

From single-employee businesses to large enterprises, Forework’s customizable payroll and HR software can be as simple or as expansive as needed for your unique operation.

Industry-specific features designed to keep you compliant with special wage and labor rules that apply to employers in every industry, including highly regulated industries.

We know labor and employment law, and we can help you navigate the nuances to your advantage while ensuring your business stays in compliance.

Personalized Support

The same support team will provide the reliable assistance you need throughout the course of our relationship.

All of our clients can expect to work with US-based employees and attorneys—not overseas call centers.

Our multi-lingual staff supports you in the language you are comfortable speaking so we can serve you efficiently and effectively.

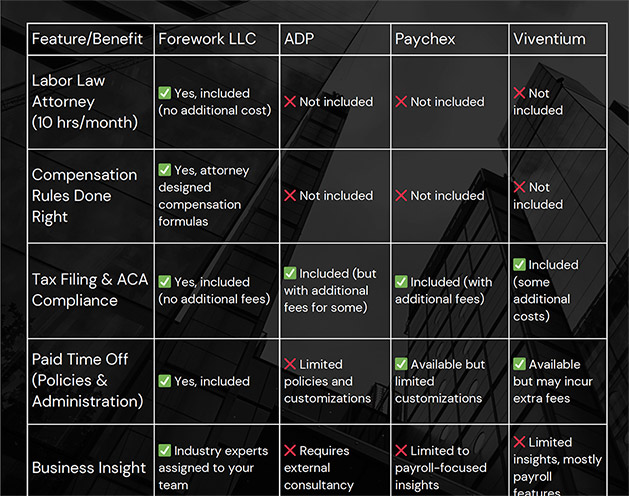

Forework v. Others

Forework is the only payroll software company developed by labor law attorneys.

Frequently Asked Questions

We know that shifting to a new system can be a daunting, time-consuming project. So, to make your decision-making process easier, here are our responses to some of the most common questions we receive from prospective clients.

See How We Can Help

Please complete this form, and we will contact you within one business day.

"*" indicates required fields